Whatever

your financial goals are, it’s important to have a checking account. A

checking account enables you to pay bills with ease and also provides

proof of payment for all your transactions. If you want open a Bank of America checking account, here’s how.

Interest Checking costs $25 a month unless you maintain a $10,000 combined balance in your checking, investment, CD and IRA accounts. You’ll also have to pay a $35 fee if you overdraft, but overdraft fees can be avoided in some cases.

You can also use the Bank of America online system to lock your debit card if you lose it, which gives you a chance to locate it and reactivate it instead of completely canceling it.

Related: Every Type of Check Fraud You Have to Protect Against

Gather Your Personal Banking Documents

You can open an account with Bank of America through its online banking system or in person. Either way, you’ll need to gather essential information to complete the application, including:- Current mailing address

- Social Security number

- Email address

- Account number for existing checking account

- Information for any joint account holder

- Driver’s license

- State-issued ID with photo

- U.S. passport

- Military ID with photo

- Bank of America-branded debit or credit card with photo

- Major credit card from another financial institution

- Major retail credit card from a national department store or retail company

- Debit card with Visa or MasterCard logo from another financial institution

- U.S. college or university ID

- U.S. student ID card from a local high school

- U.S. issued employment or work ID card or badge

Decide Which Bank of America Account Is Best for You

Once you’ve gathered your documents, you’ll need to choose the Bank of America checking account that best suits your needs. Bank of America offers two choices:- Bank of America Core Checking: This Bank of America personal checking account is designed for individuals and students who want an account that doesn’t require a high minimum balance. You can set up direct deposit with this account.

- Bank of America Interest Checking: If you maintain a high balance in your checking account, this account might be the one for you. You’ll earn interest and receive perks like no service fees and the option to open three other checking or savings accounts with no monthly maintenance fees. You’ll also qualify for the tiered Preferred Rewards program, which offers benefits such as 12 free ATM transactions a month and auto loan interest rate discounts.

Bank of America Checking Account Fees

Bank of America’s checking account fees vary. Core Checking costs $12 a month unless you have a $250 direct deposit or keep a minimum daily balance of $1,500. Students under the age of 23 enrolled in an educational institution get this fee waived.Interest Checking costs $25 a month unless you maintain a $10,000 combined balance in your checking, investment, CD and IRA accounts. You’ll also have to pay a $35 fee if you overdraft, but overdraft fees can be avoided in some cases.

BofA Checking Account FAQs

After reviewing the list of documents you need, choosing a Bank of America checking account and understanding its fee structure, you might still have a few questions. Read these answers to frequently asked questions about Bank of America online banking to further understand BofA’s options and services.Will My Checking Account Be Protected?

Each debit card has an embedded chip for extra security, and you can have your photo added to the card to help prevent fraud. In addition, you’ll get an alert if anyone makes changes to the account. If you lose your card or it is stolen, Bank of America will not hold you responsible for any fraudulent charges.You can also use the Bank of America online system to lock your debit card if you lose it, which gives you a chance to locate it and reactivate it instead of completely canceling it.

Related: Every Type of Check Fraud You Have to Protect Against

Can I Deposit a Check Without Going Into a Branch?

Yes, you can make a mobile deposit using your smartphone by following these steps:- Download the mobile banking app.

- Take a photo of the front and back of the check with your phone camera.

- Type in the exact amount of the check.

- Hit the “send” button.

- Verify the deposit on your account transaction summary either online or on your paper statement.

Do Bank of America Checking Accounts Have Special Benefits?

You can take advantage of two special benefits when you open a Bank of America checking account:- Keep the Change savings program: If you also have a savings account with the bank, Bank of America rounds up every purchase you make with your checking debit card to the nearest dollar and transfers that money to your savings account.

- BankAmeriDeals: Open the mobile app on your phone and earn cash back by clicking on the deals you want. Use your debit card to shop and the cash back you earn will be credited to your account by the end of the following month.

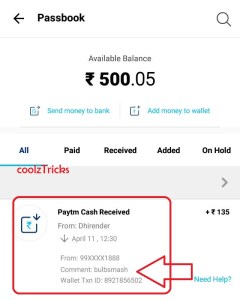

![[*LOOT*] SLIDE APP Trick-Instant Rs.5 Mobikwik Cash On Sign Up+Rs.5/Refer(Mega proof)-Aug'16](https://www.coolztricks.com/wp-content/uploads/2016/07/WhatsApp-Image-2016-08-05-at-9.26.13-AM.jpeg)

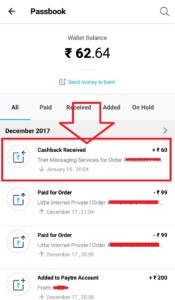

![[Loot] DataBuddy App Refer & Earn-Upto Rs.115/Refer Free Paytm Cash](https://www.coolztricks.com/wp-content/uploads/2017/05/WhatsApp-Image-2017-05-27-at-3.49.00-PM-300x133.jpeg)